Employee Tax 2024

Employee Tax 2024. The form includes pan, tan, salary details,. Rates and thresholds for employers 2024 to 2025.

For the latest information about developments related to pub. This excel calculator helps you to calculate income tax if you are salaried employee or business man.

A Comprehensive Guide For Salaried Employees.

Itr filing last date 2024.

This Excel Calculator Helps You To Calculate Income Tax If You Are Salaried Employee Or Business Man.

If an individual is earning more than rs 2.5 lakhs per annum, his or her employer should be issuing form 16.

There's No Wage Base Limit For Medicare.

Images References :

Source: atonce.com

Source: atonce.com

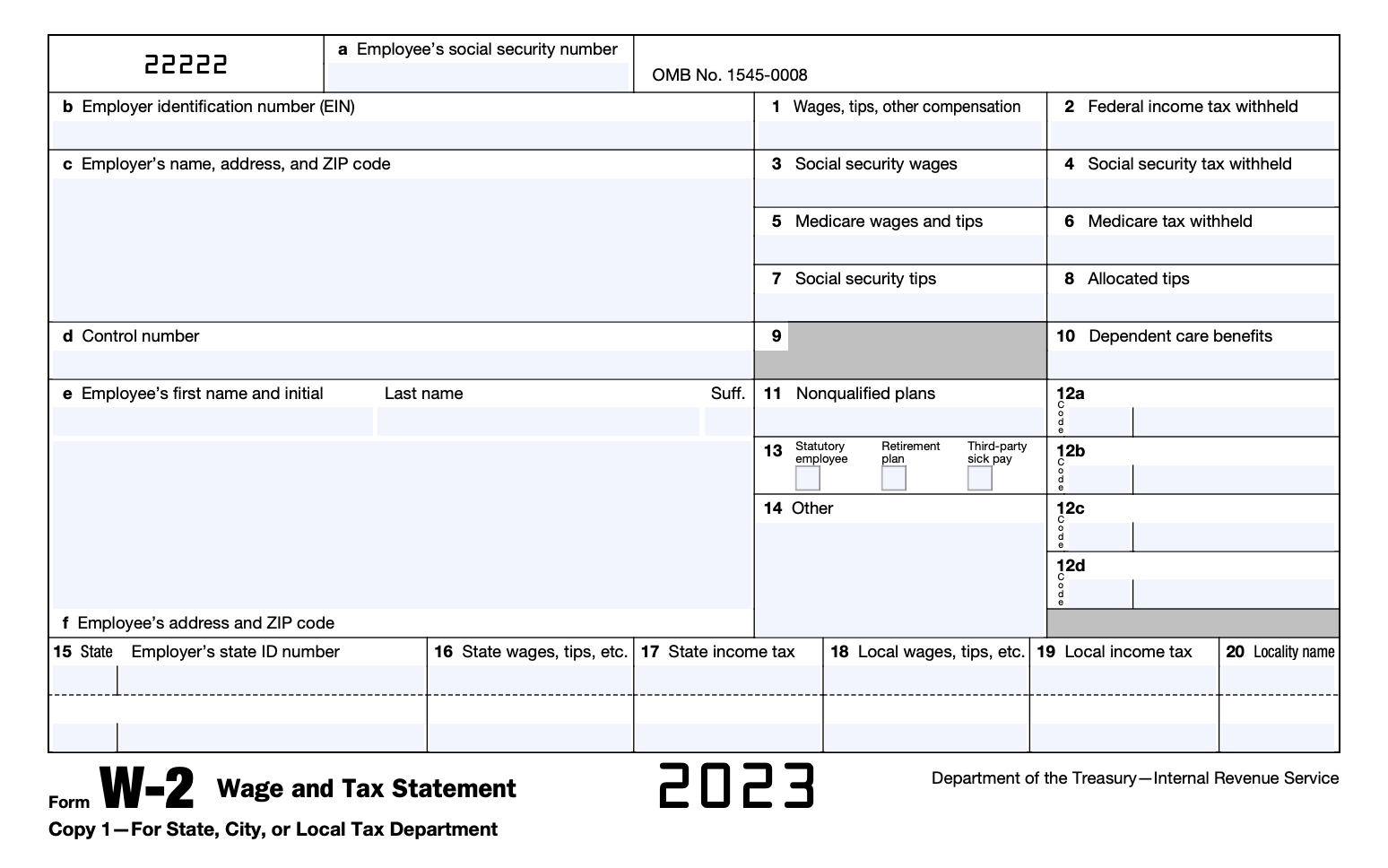

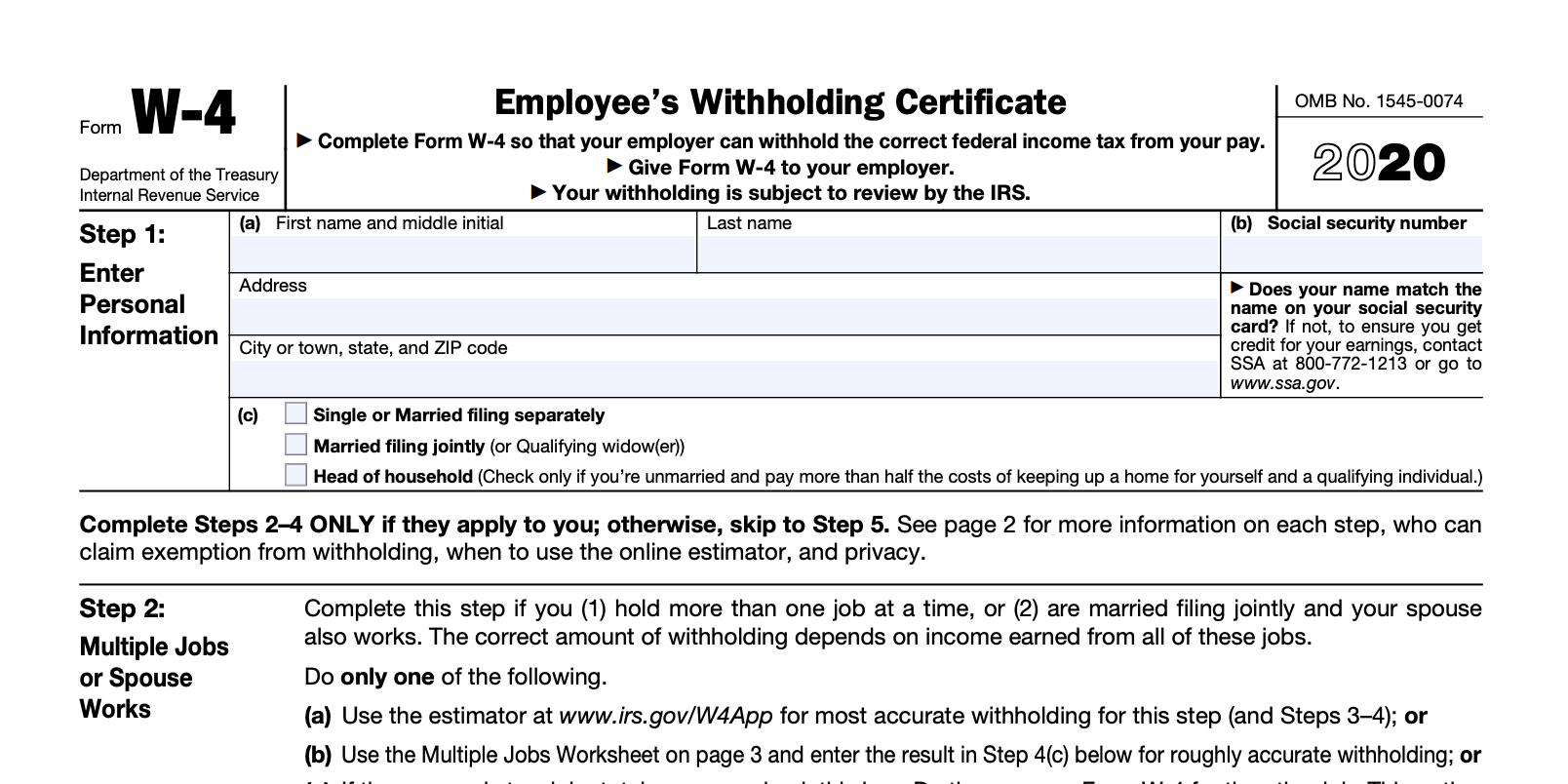

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, A comprehensive guide for salaried employees. Fica is a payroll tax that goes toward funding social security and medicare.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Make new tax regime the default tax regime for the assessee being an individual, huf,. Use these rates and thresholds when you operate your payroll or provide.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, Rates and thresholds for employers 2024 to 2025. For the salary stream, the result page has been updated to display the taxable income for the pay period.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 6.2% for the employee plus 6.2% for the employer; For the latest information about developments related to pub.

Source: fallonqlouisette.pages.dev

Source: fallonqlouisette.pages.dev

W2 Form 2024 Lucie Imojean, Federal payroll tax rates for 2024 are: Make new tax regime the default tax regime for the assessee being an individual, huf,.

Source: kara-lynnwanne.pages.dev

Source: kara-lynnwanne.pages.dev

Irs Tax Filing 2024 Sadie Collette, Make new tax regime the default tax regime for the assessee being an individual, huf,. 15, such as legislation enacted after it.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Fica is a payroll tax that goes toward funding social security and medicare. Use these rates and thresholds when you operate your payroll or provide.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is The Social Security And Medicare Tax Rate, For earnings in 2024, this base is $168,600. Use these rates and thresholds when you operate your payroll or provide.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

How to calculate payroll taxes 2021 QuickBooks, If an individual is earning more than rs 2.5 lakhs per annum, his or her employer should be issuing form 16. Canada pension plan (cpp) and employment insurance (ei) cpp contributions for 2024.

Source: kelleywlenka.pages.dev

Source: kelleywlenka.pages.dev

W 4 Form 2024 Printable Pdf Free Gnni Phylis, 15, such as legislation enacted after it. Federal payroll tax rates for 2024 are:

Check Out More Online Calculators Here Including Income Tax, Ppf, Sip,.

There's no wage base limit for medicare.

If An Individual Is Earning More Than Rs 2.5 Lakhs Per Annum, His Or Her Employer Should Be Issuing Form 16.

15, such as legislation enacted after it.